US Home Insurance Premiums May Hit a Record This Year, Report Warns

Author: Coco Liu

Original article here.

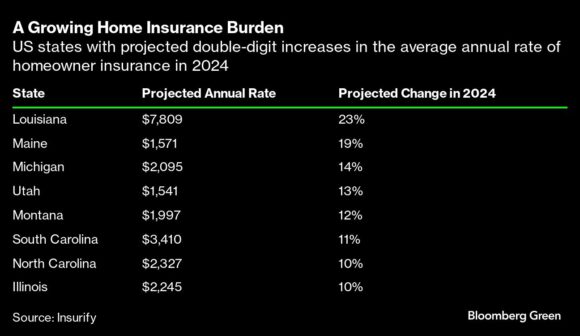

US home insurance rates are expected to reach a record high this year, with the biggest increases occurring in states prone to severe weather events, according to a new analysis.

The average premium for homeowners insurance in the US is expected to hit $2,522 by the end of the year, driven largely by intensifying natural disasters, rising reinsurance costs and higher fees for home repair, according to Insurify, a Massachusetts-based insurance-comparison platform. That figure would represent a 6% increase over the average US premium at the end of 2023, and follows a roughly 20% increase over the past two years.

“Many Americans are motivated to buy a home because they think their housing costs will remain fixed or stable when compared to renting,” says Cassie Sheets at Insurify, who co-authored the analysis. “But this trend of significant insurance rate hikes makes housing costs more unpredictable.”

Home insurance is becoming a flashpoint in the US as damage from thunderstorms picks up and as climate change increases the frequency and severity of natural disasters. In the 1980s, the country experienced about three disasters a year that caused damages of at least $1 billion each. In the 2010s, that climbed to 13 per year, according to the National Oceanic and Atmospheric Administration. Last year, the US endured a record 28 weather and climate disasters that caused at least $1 billion in damages each.

Responding to climate-induced threats, a growing number of insurance companies are pulling out of California and Florida, where those impacts are frequently felt. To fill the gap, state “insurers of last resort” are absorbing trillions of dollars in risk.

“It’s possible that the highest-risk areas will become uninsurable,” says Betsy Stella, vice president of carrier management and operations at Insurify. “However, where there’s demand, typically a supplier will appear. The question will be, at what cost?”

For Insurify’s analysis, researchers collected real-time quotes from the platform and combined them with aggregate rate filings from a third-party data provider. They then analyzed how often and by how much insurers implemented rate increases during the second half of 2023 and the beginning of 2024 and applied that pattern to the rest of this year. Insurify only looked at data for single-family frame houses that met a list of criteria around insurance type, coverage limits and homeowners’ credit score and claim history.

The steepest premiums are expected for states that also have the highest risk of natural disasters. Homeowners in Florida, who already pay the highest rates of home insurance in the country, are expected to see another 7% increase this year — bringing the state average to $11,759, more than four times the national average.

Six states, including Texas and Washington, will see their premiums remain almost flat this year, according to the analysis, which cited a healthier insurance market and the stabilizing effect of local legislation. South Dakota is the only state likely to see a meaningful drop in premiums: Its average is expected to fall about 3% to $2,488.

For states with rising premiums, Insurify’s researchers largely point the finger at the increase in natural catastrophes. According to AccuWeather, the US can expect an “explosive” hurricane season this year, with the potential for as many as 25 named storms between June and November, compared with about 14 on average. Meanwhile, sea-level rise and other adverse climate impacts are catching up with historically low-risk states like Maine.

The rising cost of reinsurance — through which insurers can hedge their risk by buying protection from other insurers — is also playing a role in higher premiums, as are the growing costs associated with home reconstruction. Insurance fraud and legal disputes also contribute to higher rates, the analysis notes. That problem is particularly acute in Florida, which accounts for 9% of home insurance claims but 79% of lawsuits over filed claims, according to a 2022 statement from Governor Ron DeSantis.